How does the acquisition of Orbital improve Northrop Grumman’s position in the military market place?

The acquisition of orbital is crucial to Northrop because it enables the firm to produce and launch large and small spy and communications satellites. The firm is also able to develop new high-speed weapons and missile defense systems that can easily detect and deter potential adversaries. The acquisition puts the company in a position to play a role in programs such as long-range bombers.

How (if any) might the acquisition improve the competitiveness of the US space program compared to other countries, such as China?

The acquisition is crucial because the country can now be able to improve its technology from focusing on surveillance to being able to disable satellites and disrupt communication, while being able to counter any disruption of its communication. The acquisition puts the country in a position to advance research into new weapons such as hypersonic missiles that can travel at more than 5,000 miles an hour. The acquisition is a step towards advancement of high-speed weapons and missile-defense systems, easily deterring potential adversaries such as North Korea, China, and Russia.

How might other companies in the defense industry, such as Boeing and Lockheed Martin, respond to the acquisition?

The acquisition gives the company a greater advantage and competitive edge, and the competitors are likely to respond by seeking to merge with other smaller companies that focuses on space, such as Harris. Apart from seeking to merge with smaller firms, defense contractors are now responding by improving and investing more on improving their space capabilities.

Northrop paid a premium price for Orbital, including $1.4 billion in debt. In the short term, what financial impact would the acquisition have on the combined firm?

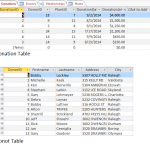

The acquisition means that the company has to take up additional staff of 13,000, adding to the existing employees. The company has to incorporate all the workers, which has financial consequences. Apart from the workers, Northrop is able to increase its revenue level by an estimated amount of $4.6 in 2017. The acquisition increases its shareholder base and as shown, the company’s share price has been on an increase. To acquire the company, the firm spend more about $9.2, choosing to pay a premium price for orbital shares.

Northrop says it expects to achieve cost savings of $150 million by 2010 from the deal. How might they achieve such savings?

By acquiring Orbital, the company is able to merge the operational cost of the two firms, and effectively cut down on the overall operation. This because the various department are fused into a one a solid team, with a single budget being used for example in advertising. The company also get to fuse employee’s trainings programs and reduce on the overall cost of employing, training, and retaining workers. The company is also able to increase the level of sales and its overall profitability level.